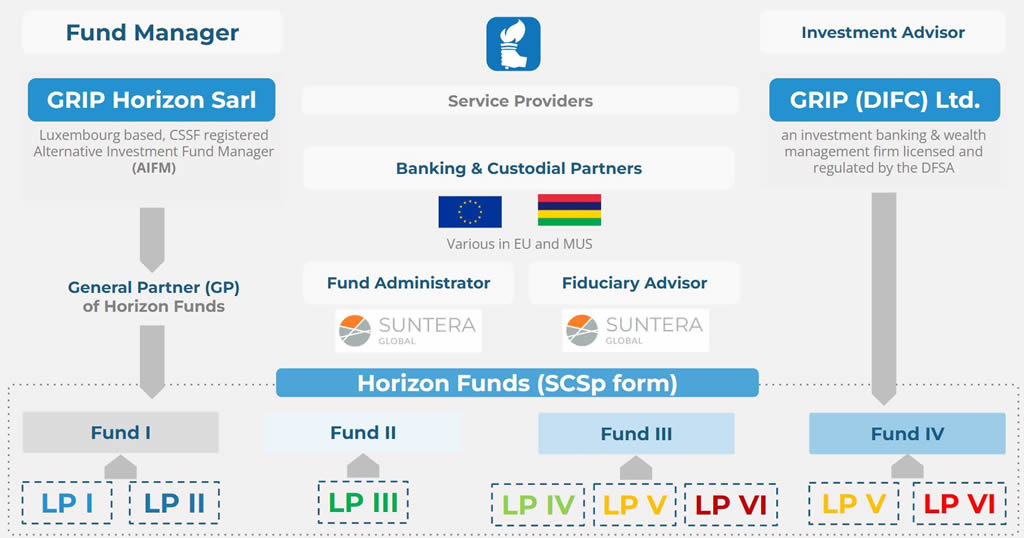

GRIP Horizon is an ecosystem built for private funds (ring-fenced investment vehicles) to enable investors implement a variety of alternative investment strategies, within the regulatory confines of Luxembourg.

Horizon funds are built to improve the efficiency of your asset management, provide control and enhance transparency in the conduct of operations and designed to enable UHNW Investors, Family Offices, Foundations Trusts and Asset Managers to implement their chosen investment strategies via their own private fund.

GRIP Horizon Sàrl as an Alternative Investment Fund Manager (AIFM) registered with the CSSF (Commission de Surveillance du Secteur Financier), in its capacity as the General Partner (GP), manages all Horizon Funds.

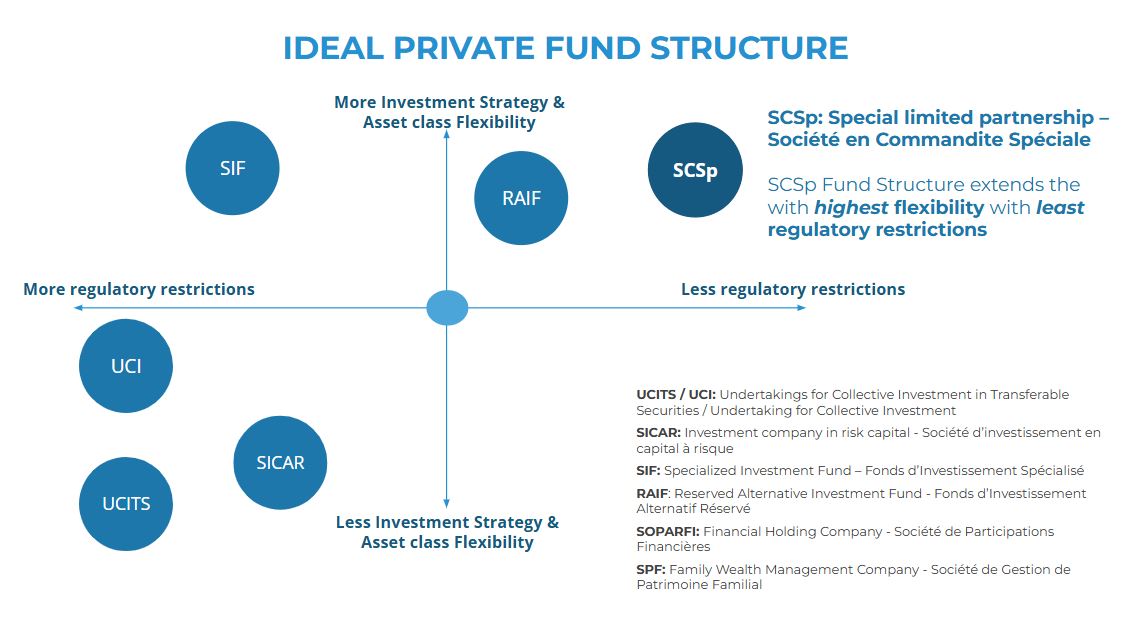

Horizon Funds are structured as SCSp (special limited partnerships / société en commandite spéciale)

Luxembourg Funds

Setup within the largest investment fund centre in Europe and the second largest in the world to offer high levels of investor protection.

Investor Privacy

Luxembourg’s company law mandates the publication of information only related to GRIP Horizon Sàrl, the General Partner and duration (limited or unlimited).

The identity of the Investors (Limited Partners) and their contributions are not subject to publication.

Investor domicile

Limited Partner (LP) entities are not required to be incorporated in Luxembourg – access for global investors.

Investors’ Limited Liability:

Each limited partner will have liability limited to the extent of their partnership interests, limiting principal losses to cumulative commitment/contribution.

Tax advantages

SCSp based fund structures are not liable to pay tax on investment gains.

Profit Distribution

Distribution parameters are determined freely under the SCSp’s partnership agreement, there exists no legal impediments for the same.

Accounting obligations

Limited obligations relative to other fund structures and corporate entities.

Formation

May be formed for an unlimited or limited duration with just one LP and one unlimited GP.

Platform

Can be operated as an umbrella fund (or a platform) with compartments or sub-funds whose assets and liabilities are segregated from other compartments or sub-funds under Luxembourg law.

GRIP Horizon S.a.r.l (GRIP Horizon) does not use ‘ESG’ factors as a decisive or reductive factor but only as an additional factor in its decision-making process. The primary aim of the investment and GRIP Horizon’s risk management policy remains creation of long-term value of the assets allowing maximization of the profits for the investors. Sustainability risks might have a negative impact on the Funds’ return.

GRIP Horizon will measure the principal adverse impacts on the sustainability factors of investment decisions for the Fund. Information on how it identifies and takes into account these impacts of investment decisions on sustainability factors will be published in the annual and semi-annual reports by GRIP Horizon as soon as the related legal provisions become applicable.